China’s CBDC Project Is Serious

The war in Ukraine signaled a shift in the global order and sanctions on Russia reveal that the West has many tools to punish its opponents. This past December, Chinese President Xi Jinping attended the first China-GCC Summit in Saudi Arabia to discuss the petroyuan and alluded to building non Western networks.

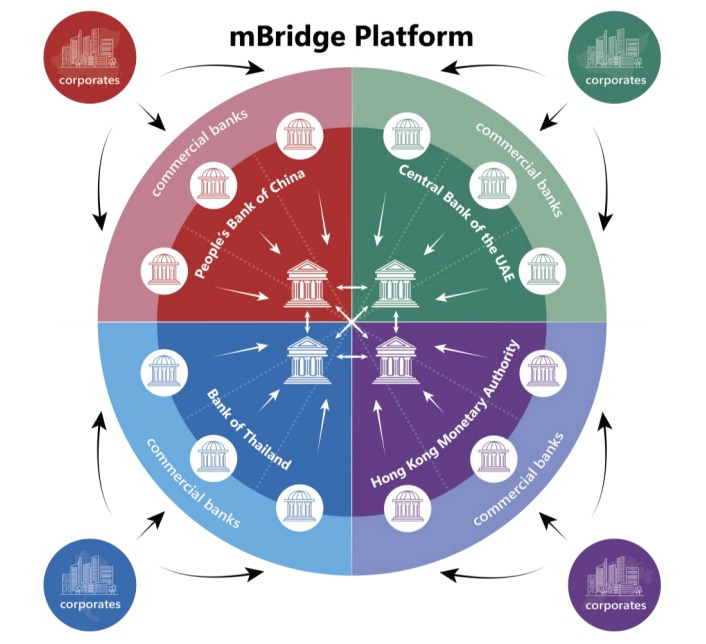

It is one thing to say that you want to trade without using the US dollar, it is another to create the liquid markets necessary for trade to take place. For this, there is the CBDC mBridge project. From August to September 2022, the People’s Bank of China was the lead participant in a CBDC pilot program that settled 44 million USD worth of CBDC transactions and whose participants included the Central Bank of the UAE, the Bank of Thailand, the Hong Kong Monetary Authority, and 20 commercial banks.

The mBridge project is not just a CBDC for China, it is a a framework for any nation to create a CBDC, pay for imports in CBDCs, and create a foreign exchange market tailored to CBDCs (e.g. swap e-CNY for e-AED).

Improving International Settlement

In a BIS report written by the participants of the CBDC pilot, they cited challenges with existing cross-border payments. Most cross-border payments are “typically made through a global network of correspondent banks involving multiple intermediaries that are fragmented across different time zones and operating hours.”

Challenges with correspondent banking included:

high costs

low transparency

counter-party / settlement risk considering that payment is in commercial bank credit

liquidity risks

A key innovation of mBridge is that transactions are settled directly in central banks reserves instead of commercial bank credit. Using elements of blockchain technology also enabled low cost instant settlement, a huge improvement over the 3 to 5 days it usually takes to settle transactions via correspondent banking.

Creating Fungibility With Existing Reserves

In order to make the value of the e-CNY equivalent to existing central bank reserves, CBDC deposits are interchangeable with existing central bank reserves. Domestic commercial banks can request that their deposits at their central bank be converted into CBDC currency (e.g. from CNY to e-CNY) and back.

Limitations of mBridge

Participants cited a lack of a price discovery mechanism when exchanging one CBDC for another. They also requested better interoperability with local systems and were curious about monetary controls that would prevent commercial banks for doing things like hoarding e-CNY for speculative purposes.

Future Ambitions

Participants mentioned they were interested in trading government bonds over mBridge and seemed optimistic about putting more effort into this project in the future. US treasuries dominate international trade and US treasury bills are considered the best collateral for borrowing the international reserve currency. China’s main challenge in escaping the US dollar will be creating the liquidity necessary to compete with US dollars and treasuries.