It is an exciting time in finance and geopolitics. We are watching the emergence of a new world order in real time. The war in Ukraine marks a tipping point where nations are making moves to regain sovereignty in a deglobalizing world. In a portion of Zoltan Pozsar’s War and Commodity Encumbrance, Zoltan discusses how China is attempting to cut the US dollar from their international trade. This makes sense in a world where using Western financial networks leave you at risk of sanctions where your adversaries play judge and jury.

China Extends their Hand to the Middle East

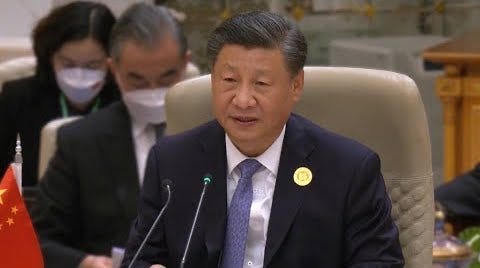

At the first China-GCC Summit on Dec 10, 2022, Chinese President Xi Jinping made a speech proposing how China and the Gulf Cooperation Council (GCC) can work together. He wants their nations to cooperate in a number of ways including cultural exchanges, nuclear and aerospace projects, trade, and finance. Xi also stated “We need to jointly uphold the principle of non-interference in internal affairs, practice true multilateralism, and defend the common interests of all developing countries.” He is alluding to his goal of building networks and alliances that thrive outside of Western influence.

Laying the Foundation for the Petroyuan

In his speech, Xi announced his goal to create the petroyuan: he wants to settle oil purchases from the GCC in Renminbi (RMB) within 5 years on the Shanghai Petroleum and Natural Gas Exchange. A significant obstacle in removing the US dollar from international trade is creating enough liquidity. As of 2022, China started accumulating gold again, and RMB is redeemable for gold in Chinese and Hong Kong gold exchanges. Liquid markets for RMB / gold gives nations the opportunity to get rid of RMB surpluses if they have any, but China hopes that RMB surpluses will be spent on Chinese capital markets and paying Chinese companies to build key GCC infrastructure. China is already paying for oil in RMB from Russia, Iran, and Venezuela.

Alliances Outside of the West

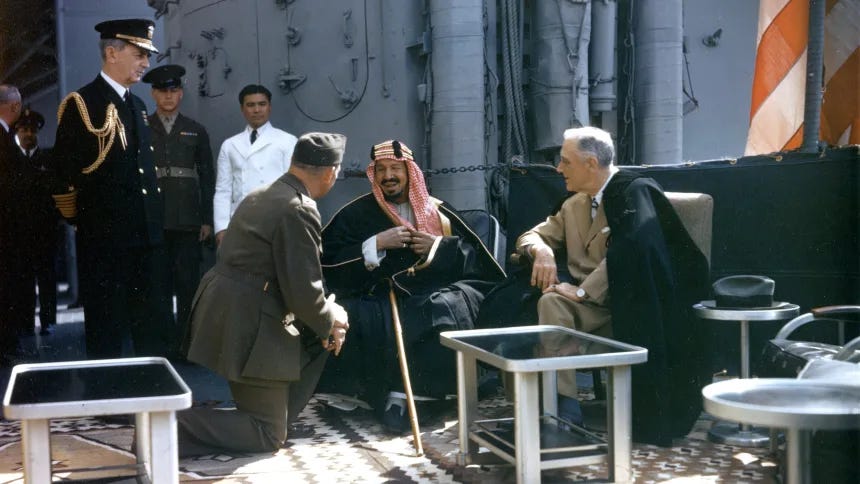

Just because the Chinese President made a bold speech doesn’t guarantee that the Middle Eastern powers will join him, however, the Middle East has grown in power since US President Franklin D. Roosevelt met with the Saudi King in 1945. Zoltan Pozsar claims that “China is now dealing with a rich Middle East, whereas FDR was dealing with a Middle East that had just started to develop.” Recently after the US asked OPEC to expand oil production to reduce pressure on international oil prices, OPEC cut production in October 2022 (source).

Those that do not directly benefit from Western hegemony are strengthening their alliances. Argentina and Iran already applied to join BRICS. Saudi Arabia, Turkey, and Egypt are expected to apply (source).

China’s CBDC is Serious

It is not an easy task to implement the financial networks necessary to dedollarize, but China is already making headway. They piloted a Central Bank Digital Currency project that included the participation of 4 central banks and 20 commercial banks, and that settled 44 million USD worth of transactions in foreign currencies. More on this next week.

Edited: I originally claimed that 30 commercial banks participated in the CBDC pilot. The correct number is 20.