US Debt Ceiling Approaches

US debt is approaching its ceiling of 31.4 trillion USD. Historically, the debt ceiling is always raised because a default on US debt can threaten global financial stability. Nik Bhatia, author of the Layered Money and Adjunct Professor of Finance at USC, estimates the debt ceiling will be reached in early June, so expect a vote on the debt ceiling around that time.

Treasury Secretary’s Statements on Debt

When questioned about the sustainability of US debt in a Senate Finance Committee on March 16th 2023, Treasury Secretary Janet Yellen made the following statements:

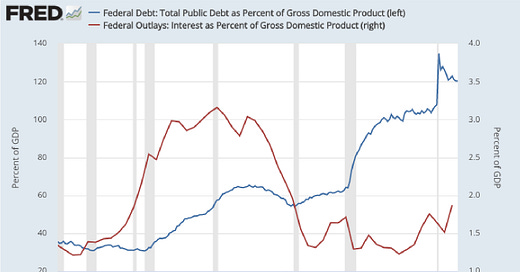

“The interest cost on the debt as a share of our economy remains quite low throughout the 10 year horizon of the Presidents budget. It remains around 1% and that is a very manageable [rate].” video source of quote

In her testimony on March 23 2023 at the House Appropriations Subcommittee, she said the following:

“I think it’s utterly imperative that we raise the debt ceiling. That is about allowing the government to pay the bills it has already incurred. It has nothing to do with future spending. And a failure by the government to pay the bills that [it has] incurred is something that would be economically and financially catastrophic. It would have a horrendous effect on financial markets where the United States is seen as an utterly secure country in which to invest. US treasuries securities are seen as the safest bedrock of our global financial system. The US dollar serves as the world reserve currency. We would be undermining that.

And even coming close to the debt ceiling without raising it, we saw in 2011 that led to a downgrade of the US credit rating, and this will raise borrowing costs for American households and businesses for a good long time. If we fail to raise the debt ceiling and had to cut spending to match the inflows of revenues that we had, we would be certain to have a recession or worse. It would be a dramatic cut in spending and the financial market consequences would be disastrous. I strongly urge Congress to raise the debt ceiling and to fail to do so would lead to economic and financial chaos.” video source of quote

Kick It Down the Road

Although there are legitimate concerns about how much the US can sustainably increase its debt over the long-term, US politicians are aware that defaulting on US debt can have a devastating impact on the world’s wealth. A default on US debt would likely result in the value of US treasuries dropping in the secondary market, putting stress on the balance sheets of financial institutions holding US treasuries and simultaneously disrupting repo markets. Repo markets enable financial institutions to get overnight US dollar loans which help them meet their US dollar liabilities. Repo markets use US treasuries as their preferred collateral.