Meditations on the Fed and Eurodollar

I am trying something new this week. In this post, I openly speculate about the Fed’s impact on markets. Even though some of my assumptions may end up wrong, this process helps me learn by thinking through the possibilities.

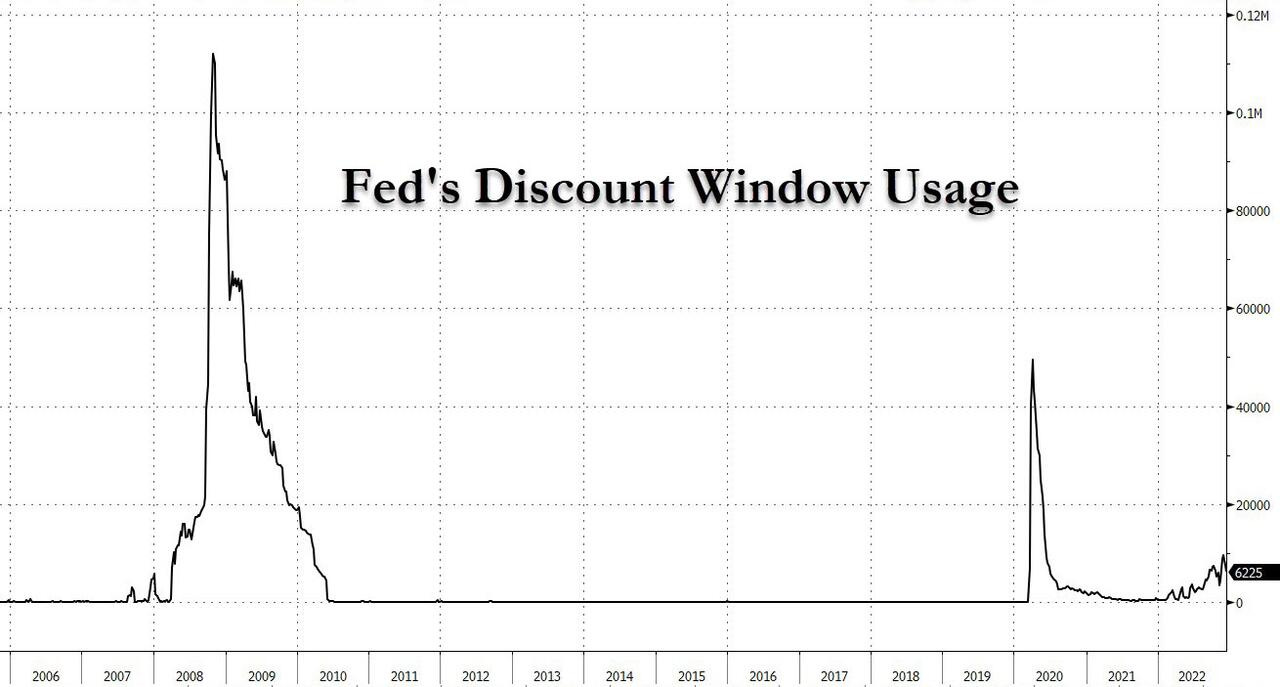

Discount Window Signals Financial Stress

I read this post by ZeroHedge which discusses how a spike in the use of the Fed’s discount window foreshadows a banking crisis. The discount window is a monetary policy tool that allows banks and other financial institutions to borrow US dollars to meet their short-term liquidity needs. Historically, financial institutions only use the discount window during times of great financial stress, such as the 07-08 financial crisis. Currently, there is another uptick in the usage of the discount window.

Eurodollar Shortage

This post made me think of arguments Jeff Snider and Ansel Lindner have made concerning Eurodollars. Unfortunately, Eurodollar is a confusing term: it has nothing to do with Euros or European government issued currency. Eurodollars are US dollars that are created by financial institutions outside of the US. When foreign banks and other foreign institutions lend each other US dollars, they create new US dollars out of thin air.

US policy and regulators have little influence over the creation of Eurodollars. Jeff Snider believes that the creation of US dollars abroad is far greater than the amount of dollars created at home. This makes sense to me considering that US dollars are needed for international trade and considering that most money created today is created in the form of credit.

Jeff also believes that there is a shortage of Eurodollars. When there is a shortage of US dollars abroad, the international finance system gets stressed. This is one reason people are watching the use of the discount window. It is a sign that there is a dollar shortage.

Is the Fed Really in Control?

Ansel Lidner and Jeff Snider both question the amount of control that the Fed actually has over the economy and also claim that their actions are often counterintuitive. One example of this is how the Fed is tackling inflation. If inflation is due to serious supply chain disruptions caused by the end of COVID 19 lockdowns and the energy market disruptions caused by the war in Ukraine, how do they expect to end it by increasing interest rates?

I know there is the argument that increasing interest rates reduces money created via credit (aka commercial bank loans), but the correct course of action seems to be letting the supply chains sort themselves out.

Their choice to raise interest rates also impacts the US treasury market, which has a huge impact on the flow of US dollars abroad. So again, most money is credit, and if Jeff is right, most money is created outside of the US. When US dollars are created and lent abroad in foreign financial institutions, they primarily use US treasuries as collateral. Why? International finance heavily relies on collateral and US treasuries are the best collateral because their payments are guaranteed by the US government.

When the Fed raised interest rates to allegedly control inflation, they also put downward pressure on the price of existing treasuries. Why buy a treasury that pays 3% interest when you can buy a new one directly from the US gov that pays 4% for the same price? International finance gets stressed when the best collateral backing the world reserve currency loses value.

When treasuries lose value, less US dollars are available to settle international transactions.

What Do You Think?

That is enough speculation for today. Disagree with anything? Let me know in the comments on Substack or in whichever social media platform you saw this in. I am excited to hear what you have to say.